$32 BILLION IN BITCOIN PURCHASED BY WHALES AS BTC MAINTAINS $100K SUPPORT

Bitcoin has shown remarkable resilience in recent days, managing to stay above the key $100,000 support level despite significant market fluctuations.

The crypto king’s ability to maintain this level under pressure highlights underlying market strength. What some may interpret as a bearish phase has, in fact, revealed solid structural support for Bitcoin, signaling that investors are standing firm even in volatile conditions.

Bitcoin Outperforms Expectations

Bitcoin is performing better than many anticipated, and the numbers back up this bullish outlook. The Realized Profit/Loss (P/L) Ratio, which tracks investors’ net profitability, currently sits at 9.1 on its 90-day simple moving average (SMA). This reflects a slight cooldown from July’s peak but still shows profits more than double those seen during the last two mid-cycle bear phases, when the ratio dropped to 3.4.

These figures indicate that investors are not panicking, and recent dips are largely the result of mild profit-taking rather than widespread capitulation. The sustained profitability among Bitcoin holders suggests that market participants remain confident in the long-term outlook, reinforcing the view that Bitcoin’s support levels are holding strong.

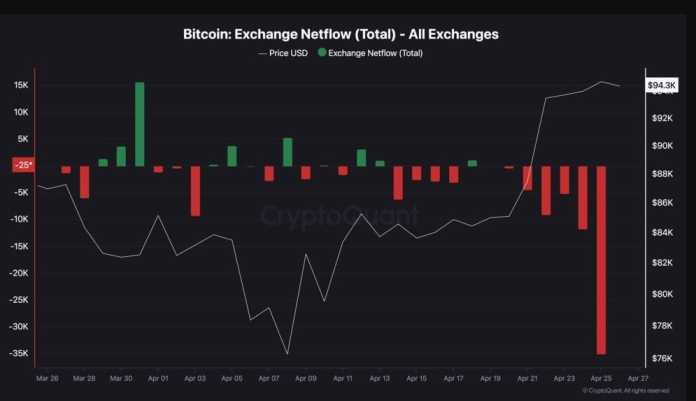

Whales Fuel Bitcoin’s Bullish Momentum

On-chain data highlights the impact of Bitcoin whales in supporting the current bullish trend. Large investors are taking advantage of brief dips to accumulate more BTC.

MICHAEL SAYLOR’S COMPANY ACQUIRES 390 MORE BTC IN LATEST $43 MILLION BUY

Addresses holding between 10,000 and 100,000 BTC have collectively purchased over 300,000 BTC this week, following a brief dip to $101,000.

This $32 billion accumulation underscores strong conviction among large holders. Their buying has helped push Bitcoin past the $105,000 mark, reinforcing the potential for an extended uptrend and signaling confidence in the market’s resilience.

BTC Price Shows Strong Recovery

At the time of writing, Bitcoin trades at $106,148, comfortably above the $105,085 support level. The recent surge, driven largely by whale buying, has pushed BTC past a key psychological resistance, signaling renewed investor confidence.

With improving market sentiment and growing institutional accumulation, Bitcoin could continue its rally toward $108,000 and potentially retest $110,000 in the coming days. Sustained demand, coupled with stable macroeconomic conditions, would further strengthen this bullish momentum.

BITCOIN HOLDS FIRM NEAR $107,000 AS RTX POISED FOR STRONG PERFORMANCE IN NOVEMBER

Potential Risks to Bitcoin’s Rally

However, if short-term traders resume profit-taking, Bitcoin’s price could slide back below $105,000. A drop of this magnitude may prompt BTC to retest support at $101,477, potentially slowing its bullish momentum in the short term.

Traders should watch for these levels closely, as renewed selling could temporarily pause or correct the ongoing uptrend.

Question 1: What key support level has Bitcoin held recently?

Answer: Bitcoin has held the $100,000 support level despite recent market volatility. This indicates that buyers are stepping in at this level to maintain stability. It reflects strong market confidence and solid structural support for the crypto.

Question 2: How much Bitcoin have whales purchased this week?

Answer: Whales have purchased over 300,000 BTC, valued at around $32 billion. These large investors are accumulating Bitcoin during minor dips, signaling confidence in its long-term upward trend. Their activity has also contributed to recent price recovery.

Question 3: What does the 90-day Realized Profit/Loss (P/L) Ratio tell us about Bitcoin holders?

Answer: The P/L Ratio currently stands at 9.1, showing that holders are largely profitable. Recent price dips are mainly mild profit-taking rather than panic selling. This suggests that investors remain confident in Bitcoin’s long-term outlook.

Question 4: What price level did Bitcoin recently surpass due to whale buying?

Answer: Bitcoin recently broke $105,000, surpassing a key psychological resistance. This surge was driven by whale buying and growing institutional accumulation. It reflects renewed investor optimism and strong bullish momentum.

Question 5: What could happen if short-term traders start selling again?

Answer: If short-term traders resume profit-taking, Bitcoin could fall below $105,000 and retest support at $101,477. This would temporarily slow the bullish momentum. However, the long-term confidence of whales and investors may still support the market.