The $19 Billion Crypto Crash That Shook the Market

The sell-off began quietly, with Bitcoin hovering around $122,000 late on October 9. Within hours, sudden sell pressure hit major exchanges, triggering a cascade of automatic liquidations on overleveraged futures positions. As long positions started closing, prices fell faster, forcing more liquidations in a classic domino effect.

By early October 10, the move had spread across the crypto ecosystem. Major exchanges like Binance, OKX, and Bybit reported record-high liquidation volumes, while CoinGlass data showed more than $19 billion in open interest wiped out. Analysts noted that unusually high leverage — in some cases over 100x — made the market especially fragile.

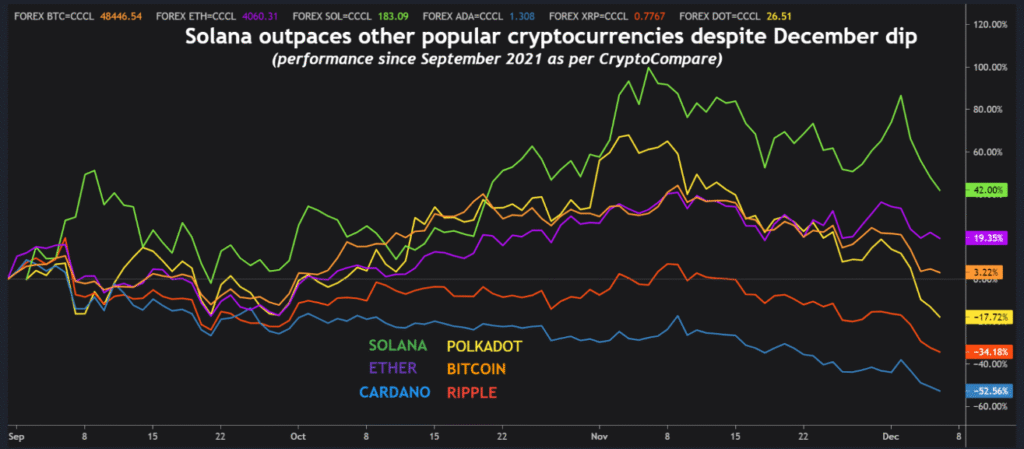

Altcoins bore the brunt of the sell-off. Popular names such as Ethereum (ETH), Solana (SOL), and Avalanche (AVAX) lost between 35% and 60% in just a few hours, erasing weeks of gains. Stablecoins briefly showed minor deviations from their pegs as traders rushed to cash or stable assets.

TRUMP COIN CREATORS SEEK $200M TO LAUNCH TREASURY-FOCUSED COMPANY

Despite the chaos, blockchain data revealed that some large investors — often called “whales” — used the crash to accumulate Bitcoin at discounted levels. This helped stabilize the market around $110,000, marking a temporary bottom before a partial rebound.

What Triggered the Crash?

Analysts remain divided over what caused such an extreme liquidation. Some point to Donald Trump’s 100% tariff threat on China, announced just a day earlier, which rattled global markets and weakened risk sentiment across stocks and crypto. Others blame excessive leverage and poor risk controls on major exchanges, which allowed retail traders to take on unsustainable exposure.

A third theory suggests a coordinated liquidation event, where large market players deliberately pushed prices below key support levels to trigger stop-losses and collect liquidity. While unproven, this idea gained traction after unusual trading patterns appeared across several platforms.

Lessons Learned from Crypto’s Black Friday

The $19 billion liquidation serves as a stark reminder of how fragile crypto markets can be when excessive leverage meets global uncertainty. Despite Bitcoin’s long-term strength, short-term greed and high-risk trading can turn small corrections into massive wipeouts.

One clear lesson is that risk management matters more than hype. Many traders ignored warning signs—such as rising open interest and tightening liquidity—and kept adding leveraged longs even as volatility climbed. When the market turned, those positions were the first to go.

Another takeaway is the importance of diversification and discipline. Relying solely on high-risk futures or altcoins can expose traders to catastrophic losses. Holding a balanced portfolio, keeping stop-losses tight, and avoiding overexposure remain essential for survival in crypto’s fast-moving world.

BITCOIN JUST CROSSED $125,600—COULD IT REALLY HIT $150K NEXT?

For long-term investors, the crash also reinforced a deeper truth: Bitcoin remains volatile but resilient. Each major correction clears out speculative excess and resets the market for a healthier recovery phase. Those who manage risk—instead of chasing every rally—are the ones who endure the storm and thrive when stability returns.