BITCOIN BREAKS ABOVE $100 K AMID RENEWED MOMENTUM IN THE CRYPTO MARKET

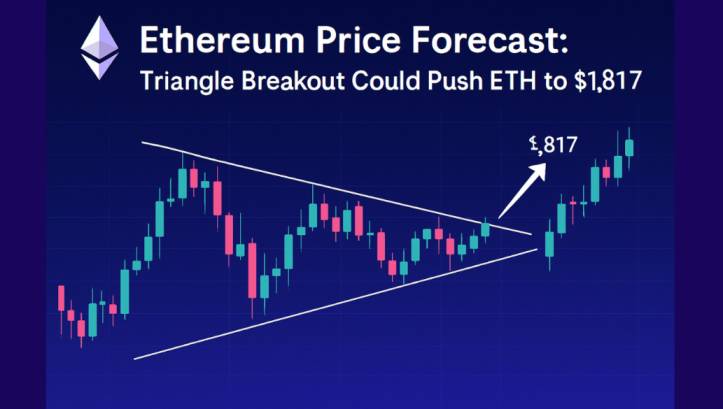

The cryptocurrency market is showing renewed strength as Bitcoin stays above $100,000, rising 2.2% to $103,573. Other major coins, including Ethereum, Solana, and XRP, also gained more than 5% in the past 24 hours. Experts believe this steady rise reflects growing confidence from institutional investors rather than short-term retail hype. Traders and investors are now watching closely to see if the positive momentum can continue in the days ahead amid changing market conditions.

What’s Behind the Growing Institutional Interest?

Institutional investors have increasingly become the backbone of the current crypto market surge. Their growing involvement is seen as a sign of maturing confidence in digital assets. Analysts note that the market’s recent rise, unlike earlier retail-driven rallies, is marked by cautious and calculated accumulation rather than speculative enthusiasm. The absence of extreme FOMO (fear of missing out) among retail traders has contributed to improved market stability.

INVESTOR CAUTION GROWS: CRYPTO FEAR INDEX RISES WHILE BITCOIN FALTERS

Institutions are typically motivated by long-term strategies, relying on data, technical indicators, and macroeconomic conditions rather than emotional sentiment. This disciplined approach has reduced the likelihood of sudden price swings and panic selling, making the market appear more resilient. Still, experts warn that if retail participation increases abruptly, it could introduce short-term volatility and possible corrections.

According to on-chain analytics firm Glassnode, many traders are still holding back from making new entries, reflecting a cautious mood. The firm highlighted that “a sustained recovery requires renewed inflows and reclaiming the $112K–$113K region as support,” indicating that strong buying momentum from institutional players will be crucial for maintaining this rally’s pace.

How Are Bitcoin and Crypto ETFs Performing?

In the exchange-traded fund (ETF) segment, recent movements have presented a mixed picture. U.S. spot Bitcoin ETFs collectively saw inflows worth $238.5 million after a period of consecutive outflows, signaling temporary stabilization in investor confidence. These inflows show that large investors are beginning to re-enter the market, viewing Bitcoin as a valuable hedge amid economic uncertainty. However, the trend remains uneven—BlackRock’s iShares Bitcoin Trust (IBIT), one of the largest funds, reported notable outflows, reflecting that some institutions are still cautious about short-term price movements.

Ethereum ETFs followed a similar trend, showing inflows in most funds except for BlackRock’s. This mixed activity highlights the uncertainty surrounding Ethereum’s long-term price direction and its evolving role in the market. Meanwhile, new entrants like the Bitwise U.S. Spot Solana ETF continue to post positive inflows, suggesting growing interest in alternative blockchain projects beyond Bitcoin and Ethereum.

The crypto community is also keeping a close eye on the potential launch of an XRP ETF, which could further diversify institutional exposure in the market. Such developments indicate that crypto-based investment vehicles are slowly gaining mainstream traction, even amid market fluctuations.

SAYLOR TRANSFERS $2.45B WORTH OF BITCOIN—WHAT’S BEHIND THE MASSIVE MOVE?

Overall, ETF flows serve as a vital barometer of institutional sentiment and market confidence. Consistent inflows typically signal optimism and can help support prices, while outflows often indicate profit-taking or risk aversion. As regulatory discussions intensify and new investment products emerge, analysts believe the coming months will be critical in shaping the next phase of institutional adoption in crypto markets.