SOLANA NEARS A 20% ZONE THAT COULD TRIGGER ITS NEXT MAJOR UPSWING

Solana’s price has climbed nearly 6% in the past 24 hours and is now trading close to $167. The move looks promising—but the real test lies ahead. For the next major rally to begin, Solana needs to gain another 20% and break above the $202 resistance level that has repeatedly stopped its upward runs.

This $202 mark isn’t just another price point—it’s a major psychological barrier that has rejected Solana several times before. A decisive break above it could open the path toward a stronger rally, but another rejection may trigger a pullback. The real question is: Are there enough buyers this time to push it through?

Right now, the signs suggest buying momentum remains cautious.

BITCOIN SEES 28,000 BTC SELL-OFF BY SHORT-TERM HOLDERS—A SIGN THE BOTTOM IS CLOSE?

Short-Term Holders Take Profits as Selling Increases

To understand the current slowdown, it helps to look at what investors are doing. Data shows that short-term Solana holders—those who have held the token for one week to one month—are starting to sell early.

Their share of the total supply has dropped from 14% to 11%, indicating many traders are locking in profits instead of waiting for further gains.

This trend is highlighted by the HODL Waves metric, which tracks how long different groups of investors hold their coins. The decline in short-term holdings points to a shift in sentiment, with fewer traders willing to bet on an immediate continuation of Solana’s rally.

Solana Faces Selling Pressure Despite Rising Prices

Data shows that over 730,000 SOL moved to exchanges this week. When coins flow into exchanges, it usually indicates that sellers are preparing to dump, not that investors are buying to hold.

This suggests that large holders may be ready to sell if the price climbs further—a familiar roadblock for Solana. Every time the price rises, selling pressure tends to appear.

So, even though Solana is showing gains, some of the biggest players remain cautious. This selling pressure could slow momentum before Solana even reaches $180, a level that would signal stronger conviction from buyers.

BANKS TARGET STABLECOINS AND DEFI, SPARKING STRONG REACTIONS FROM THE CRYPTO COMMUNITY

Indicators Slowly Turning Positive

Despite the selling, not all signs are bearish. Money flow indicators show that buying momentum is gradually returning. The Chaikin Money Flow (CMF), which tracks whether money is moving in or out of a coin, has broken its downtrend, indicating improving inflows.

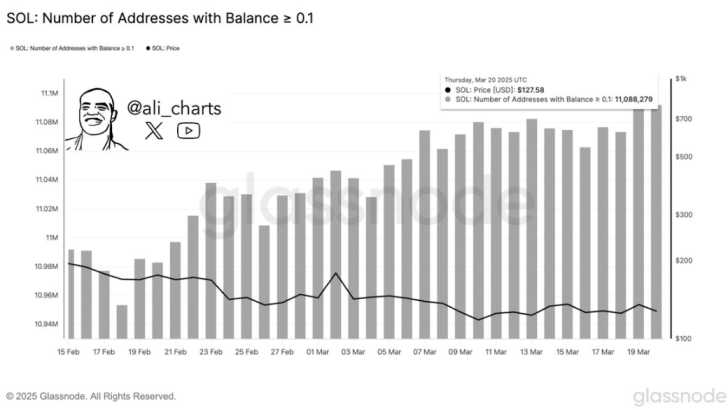

Source: Glassnode

However, the CMF is still below zero, suggesting that significant buying is not yet fully underway. In many cases, CMF reflects movements by large holders, or “whales.”

This could mean that Solana whales are slowly returning to the market, hinting at potential support for a future rally.

Buying Momentum Still Limited

Although there are signs of inflows, buying pressure is not yet strong enough to push Solana’s price higher. For a definitive momentum shift, the Chaikin Money Flow (CMF) must rise above zero and stay there for a period.

Meanwhile, the derivatives market, where traders leverage positions to speculate on future prices, shows no clear direction. This indicates that overall market sentiment remains cautious, with traders waiting for stronger signals before making commitments.

The 20% Push That Could Drive Solana’s Next Rally

At press time, Solana is trading near $167. For the next major rally to take hold, the price would need to climb to $202, representing a 20% increase. Reaching this level could confirm that a stronger rally is underway.

However, if selling pressure persists or buying momentum slows, the move could fail before hitting that target. On the downside, a drop below $150 could invalidate current bullish sentiment.

The key to a breakout is strong, sustained buying that can push Solana past $202. Until that happens, each upward move may face resistance, and each dip could test traders’ patience. Simply put, a larger SOL price rally depends on first achieving this smaller 20% gain.