CRYPTO FUNDS FAVOR SOLANA OVER BITCOIN AND ETHEREUM, DRIVING SOL MOMENTUM

Solana ETFs Buck Market Trend as Investors Pull from BTC and ETH

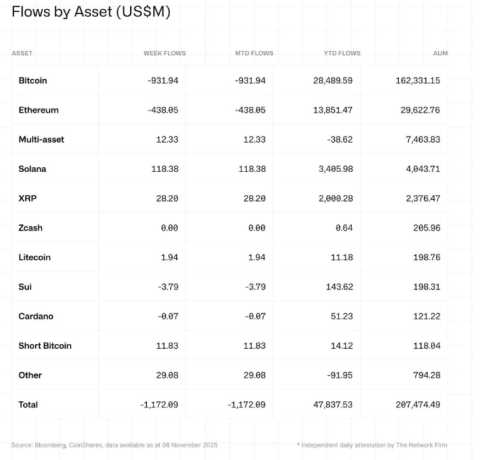

Last week, crypto-linked ETFs saw over $1.2 billion in outflows amid broader market weakness. Bitcoin ETFs were hit hardest, losing nearly $1 billion, while Ethereum-linked funds fell by $432 million.

In contrast, Solana (SOL) ETFs closed the week with positive inflows of $118 million, signaling continued institutional confidence in Solana’s growth potential. Spot ETFs managed by REX-Osprey and Bitwise were the primary beneficiaries, allowing investors to capitalize on SOL’s recent dip below $150.

At present, the two Solana spot ETFs have amassed a combined $782 million in assets, with the Bitwise Solana ETF (BSOL) leading the pack. Its higher staking reward structure has attracted yield-focused investors, helping it outperform competitors despite being launched only weeks ago.

This trend highlights a bullish sentiment for Solana, even as Bitcoin and Ethereum funds face outflows, suggesting investors are increasingly seeking high-potential altcoin opportunities amid broader market volatility.

Solana Price Prediction: Bullish Breakout Could Drive SOL Toward $300

The daily chart for Solana (SOL) shows the token recently bounced off a key demand level at $155, suggesting a potential bottom after a downtrend since mid-September. SOL struggled to stay above $200, but recent ETF inflows indicate renewed institutional interest and a possible local recovery.

For a bullish scenario to unfold, SOL would need to break out of its descending price channel and move above the 200-day exponential moving average (EMA). If this happens, the token could reclaim the $200 level, building momentum toward $300 and potentially setting the stage for a new all-time high.

SOLANA NEARS A 20% ZONE THAT COULD TRIGGER ITS NEXT MAJOR UPSWING

Investors looking to position themselves ahead of the next breakout might also consider early-stage presales such as Pepenode ($PEPENODE). This innovative mine-to-earn (M2E) crypto game allows users to mine meme coins using virtual mining rigs, without requiring any physical hardware, and has already attracted millions in early investments.

With both institutional interest and retail innovation on the rise, Solana could be poised for a strong recovery in the near term.

Pepenode ($PEPENODE) Makes Meme Coin Mining Easy and Hardware-Free

Pepenode ($PEPENODE) is transforming crypto mining by removing the biggest barrier for most users: expensive hardware. Instead of setting up physical rigs, players can launch virtual servers, deploy mining rigs instantly, and scale their operations entirely online.

ETHEREUM USERS PAY ONLY $0.04 PER TRANSACTION AMID REDUCED ACTIVITY

This gamified approach makes mining accessible to everyone, letting users participate without technical hassles or upfront costs. The project also encourages competition, rewarding top miners with meme coin airdrops like Bonk ($BONK) and Fartcoin ($FARTCOIN). Additionally, 70% of $PEPENODE spent on upgrades is burned, helping reduce the circulating supply and increase scarcity.

As the game gains popularity, demand for its utility token is expected to rise, and analysts anticipate $PEPENODE could see rapid growth once the presale concludes.

To get in early, visit the official Pepenode website and connect a compatible wallet, such as Best Wallet. Users can swap USDT or ETH, or even complete purchases via bank card, making participation easy for everyone.

Crypto Q&A: Solana, Pepenode, and Market Insights

ETHEREUM USERS PAY ONLY $0.04 PER TRANSACTION AMID REDUCED ACTIVITY

Q: What happened to crypto ETFs last week, and how did Solana perform?

A: Last week, crypto-linked ETFs saw over $1.2 billion in outflows, with Bitcoin ETFs losing nearly $1 billion and Ethereum-linked funds dropping $432 million. In contrast, Solana ETFs received $118 million in positive inflows, showing strong institutional interest in SOL despite the broader market decline. Spot ETFs like those from REX-Osprey and Bitwise have now amassed a combined $782 million in assets, signaling continued confidence in Solana’s growth potential.

Q: What is the current technical outlook for Solana (SOL)?

A: SOL recently bounced from a key demand level at $155, after a downtrend that started in mid-September. For a bullish breakout, SOL would need to escape its descending price channel and surpass the 200-day EMA. If that happens, analysts predict SOL could reclaim $200 and potentially reach $300, setting the stage for a new all-time high. ETF inflows suggest institutional investors see this as a buying opportunity.

Q: How does Pepenode manage token supply and incentivize growth?

A: The game implements a burn mechanism: 70% of $PEPENODE spent on in-game upgrades is permanently removed from circulation, helping reduce supply and potentially increasing token value. As the platform grows in popularity, demand for $PEPENODE is expected to rise, making it attractive for early-stage investors.

Q: How can users participate in the Pepenode presale?

A: Investors can purchase $PEPENODE through the official Pepenode website using a compatible wallet such as Best Wallet. Payment options include USDT, ETH, or even a bank card, making the presale accessible to a wide range of users without technical barriers.

Q: Why are analysts optimistic about Solana and Pepenode in the current market?

A: Analysts highlight two main reasons:

Solana ETFs continue to attract institutional inflows even amid market weakness, suggesting confidence in SOL’s medium-term recovery and growth.

Pepenode introduces a novel, gamified way to mine meme coins without hardware, attracting early investors and creating demand for its utility token.

Together, these trends indicate that both SOL and $PEPENODE could outperform broader market trends if momentum continues and SOL breaks key technical resistance levels.