BITCOIN CLIMBS TO $104K—IS A STRONG YEAR-END RALLY COMING

Bitcoin Price Outlook: Could BTC’s $104K Breakout Trigger a Massive Year-End Rally?

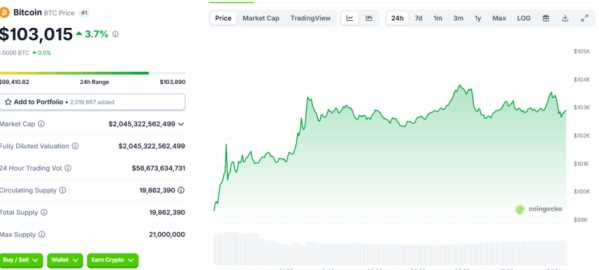

Bitcoin Price Prediction 2025: Bitcoin (BTC) is currently trading near $102,100, as investors digest a mix of market signals. Corporate Bitcoin holdings continue to grow, even as MicroStrategy’s share of total reserves dips to 60%. Analysts are closely watching price patterns and institutional activity, suggesting that BTC may be gearing up for a significant year-end move.

Corporate Bitcoin Adoption Continues Despite MicroStrategy’s Decline

MicroStrategy remains the largest corporate holder of Bitcoin, now holding 640,808 BTC, which is 60% of total corporate reserves—down from 75% earlier this year. The decline indicates a more diversified adoption of Bitcoin across companies, rather than reliance on a single corporate giant.

October saw slower accumulation, with public and private firms adding just 14,447 BTC, the lowest monthly increase of 2025. Notable buyers included:

Coinbase: 2,772 BTC

Japan’s Metaplanet: 5,268 BTC

Fidelity Digital Assets notes that corporate Bitcoin holdings continue to tighten liquid supply, as companies prefer long-term holding over selling, supporting BTC’s bullish fundamentals.

UK STABLECOIN RULES: MAJOR UPDATES AND WHAT THEY MEAN FOR THE MARKET

Morgan Stanley Warns of Profit-Taking Season

Morgan Stanley strategist Denny Galindo describes Bitcoin as entering its “fall season,” a phase in the four-year market cycle where investors often take profits before potential short-term corrections. Galindo likens this to a natural rhythm: “three-up, one-down,” with fall representing profit harvesting.

Despite this caution, institutional demand remains strong. Michael Cyprys from Morgan Stanley highlighted that Bitcoin ETFs now hold over $137 billion in assets, demonstrating robust confidence in BTC’s long-term trajectory.

U.S. Dollar Strength Adds Short-Term Pressure

The U.S. dollar gained strength amid expectations that the government shutdown would soon end and delayed economic data—including key employment reports—would be released. The Dollar Index rose 0.19% to 99.63, causing short-term pressure on Bitcoin.

Meanwhile, other currencies weakened:

Japanese yen: hit its lowest since February

British pound & Euro: edged lower against the dollar

A stronger dollar tends to temporarily reduce risk-on appetite, which may explain BTC’s recent consolidation around $102K.

BTC Technical Analysis: Triangle Pattern Points to $104K

Bitcoin is forming a symmetrical triangle on the 4-hour chart, signaling a coiling pattern before a potential breakout. Key indicators include:

Support: $101,000, confirmed by a hammer candle suggesting buyer interest

20-EMA vs 50-EMA: 20-EMA sits just below 50-EMA, indicating caution but hinting at a potential bullish crossover

RSI: 48 (neutral), suggesting momentum could shift either way

BINANCE. U.S. DENIES POLITICAL INVOLVEMENT AFTER LISTING TRUMP-LINKED STABLECOIN USD1

Potential breakout scenarios:

Upside: Above $104,000 → possible rally to $107,500 → $110,900

Downside: Below $99,200 → pullback toward $96,200–$93,400

Traders are watching closely, as the breakout direction may set the tone for the rest of Q4 2025.

Bitcoin Hyper ($HYPER): The Next Evolution of BTC on Solana

Bitcoin Hyper is introducing Solana-level speed to Bitcoin, combining BTC’s security with Solana’s high-performance framework. Key features include:

Lightning-fast, low-cost smart contracts

Decentralized apps (dApps) and meme coin creation

Fully secured by Bitcoin’s base layer

The project, audited by Consult, emphasizes trust, scalability, and adoption readiness. Its presale has already surpassed $26.9 million, with tokens priced at $0.013255, making it an attractive early-stage investment opportunity.

Bitcoin Hyper aims to bridge the gap between Bitcoin and Solana, providing the foundation for faster, more flexible, and innovative crypto applications as the ecosystem grows.

FAQs

What is Bitcoin currently trading near?

Bitcoin is trading around $102,100 as investors weigh mixed market signals. It has been consolidating while forming a technical pattern that could indicate a breakout.

Which company remains the largest corporate holder of BTC?

MicroStrategy continues to be the largest corporate Bitcoin holder, with 640,808 BTC, representing 60% of total corporate reserves, though its share is declining as other companies add BTC.

What technical pattern is Bitcoin forming that suggests a possible breakout?

Bitcoin is forming a symmetrical triangle on the 4-hour chart. This pattern indicates that the market is coiling and may experience a breakout either above resistance or below support.

What is Bitcoin Hyper ($HYPER) designed to do?

Bitcoin Hyper combines Bitcoin’s security with Solana-level speed, enabling lightning-fast smart contracts, decentralized apps, and meme coin creation while maintaining BTC’s stability.

What could happen if Bitcoin breaks above $104,000?

A confirmed break above $104,000 could trigger a rally toward $107,500–$110,900, potentially signaling a strong year-end move and renewed bullish momentum.