RIPPLE INVESTS $4 BILLION TO GROW ITS NETWORK—IS XRP HEADING TO $5?

Ripple Labs is making a bold move to bridge traditional finance (TradFi) and blockchain technology, investing nearly $4 billion in financial services infrastructure. By acquiring key platforms, Ripple aims to connect its Web3 ecosystem with the existing financial network, potentially opening the door to increased institutional demand for XRP. Analysts believe this could support a bullish price trajectory for the cryptocurrency.

BITCOIN MINER DEFIES 1-IN-10-MILLION ODDS—BUT IS SOLO MINING STILL PROFITABLE IN 2025?

Major Acquisitions Drive XRP Momentum

In 2025, Ripple has been busy expanding its influence in the financial sector:

- Hidden Road (Ripple Prime)—Acquired for $1.3 billion in April, now serving as Ripple’s flagship brokerage for institutional clients.

- GTreasury—Purchased for over $1 billion later in the year, enhancing Ripple’s corporate finance and treasury management offerings.

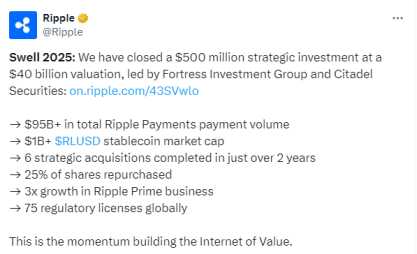

Last week, Ripple launched a new institutional offering through its brokerage platform, enabling U.S.-based firms to access OTC spot trading across multiple tokens. This move raised $500 million and lifted Ripple’s market capitalization to $40 billion.

CEO Brad Garlinghouse described 2025 as a record-setting year for both Ripple and the crypto sector. He emphasized that Ripple’s TradFi-crypto strategy validates its long-term growth approach, built on XRP’s foundation.

$113M ETHEREUM PURCHASE: BITMINE GROWS TREASURY WHILE ETH REMAINS ABOVE $4K

Industry experts also recognize Ripple Prime’s impact. Michael Arrington, founder of CrunchBase and Arrington Capital, noted that Ripple Prime offers hedge funds unprecedented tools to engage with financial markets, reinforcing confidence in XRP’s institutional appeal.

XRP ETFs Signal Growing Institutional Confidence

Adding to the positive outlook, 11 XRP-linked exchange-traded funds (ETFs) are preparing to launch, providing investors with spot exposure to the Ripple token. Top ETF issuers include:

- Canary Capital

- Bitwise

- CoinShares

Franklin Templeton

The first U.S. spot XRP ETF from Canary Capital is expected to list on Nasdaq soon, with trading to commence immediately after the launch. Analysts predict these ETFs could push XRP toward $5 heading into 2026.

Crypto analyst ChartNerd noted that XRP has been in vertical accumulation since January 2025, with the 1.618 Fibonacci extension pointing toward $5–$6 once the $2.60 resistance level is broken. Meanwhile, Maria Carola, CEO of StealthEx, added that ETF inflows and easing monetary policy could see XRP approach $2.5 resistance by late November.

“Bitcoin’s dominance slipping below 60% signals a renewed rotation into altcoins like XRP as traders seek higher returns,” she said.

Altcoin Season and Utility Tokens: Best Wallet Token (BEST) Presale

With growing interest in altcoins, utility projects in presale rounds are capturing investor attention. Best Wallet Token (BEST) is one such project, raising approximately $17 million during its presale.

The platform is a multi-chain self-custody wallet secured with Fireblocks’ MPC technology, offering features like

- Lower trading fees

- Enhanced staking returns

- Participation in governance decisions

- Early access to select token presales

Additionally, the wallet supports cross-chain swaps and includes a built-in launchpad for new blockchain projects.

Investors have only 15 days remaining to participate at the current presale price of $0.025935 per token. Staking $BEST can yield up to 77% annually, making it an attractive option for early adopters.

Conclusion

Ripple’s aggressive investment in TradFi infrastructure, combined with the upcoming XRP ETFs and rising institutional adoption, sets the stage for a potential bullish breakout toward $5. Meanwhile, altcoin projects like Best Wallet Token (BEST) are capitalizing on renewed investor interest, offering opportunities for both utility and yield-focused strategies.

FAQs

- What major financial moves has Ripple made in 2025?

Ripple invested nearly $4 billion in acquisitions, including Hidden Road (Ripple Prime) for $1.3B and GTreasury for over $1B, connecting blockchain with traditional finance.

2. How could these acquisitions affect XRP’s price?

Analysts say these moves open institutional liquidity and adoption, supporting a bullish outlook and the potential for XRP to reach $5 in the near term.

3. What is the significance of XRP ETFs?

Eleven XRP-linked ETFs are launching, offering spot exposure to institutional investors, which could drive demand and push XRP prices higher.

4. What does the Best Wallet Token (BEST) presale offer?

BEST is a multi-chain self-custody wallet token presale, offering lower fees, staking rewards, governance participation, and early access to other crypto projects.

5. What is Ripple CEO Brad Garlinghouse’s view on 2025 for XRP?

Garlinghouse calls 2025 a record year, highlighting Ripple’s TradFi-crypto strategy as validation of XRP’s growth and its role in the future of digital finance.