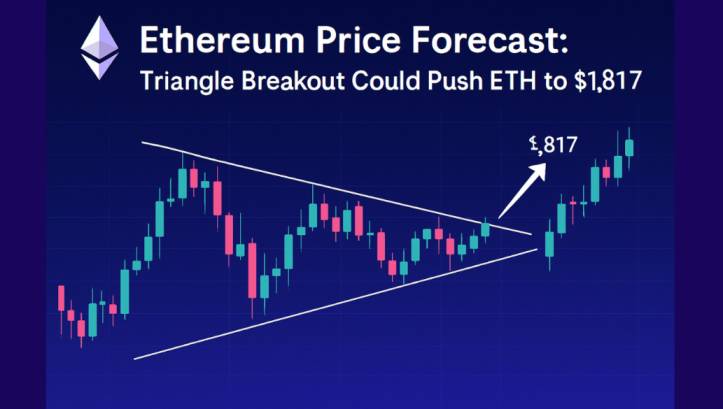

ETH PRICE TIGHTENS IN TRIANGLE FORMATION: WILL THE NEXT MOVE BE UPWARD?

Ethereum’s price is tightening into a triangle pattern as market volatility decreases, suggesting a potential breakout may be on the horizon. Over the past few weeks, ETH has been consolidating within this narrowing structure, with support and resistance lines converging toward a critical apex.

Such compression often signals that a strong directional move is coming. Traders will be closely watching the next sessions, as a confirmed breakout with solid volume could set the stage for a significant price expansion.

BTC BATTLES $95K RESISTANCE AS VOLATILITY HITS DOUBLE DIGITS

Ethereum Technical Outlook: Triangle Apex Signals Imminent Move

Ethereum’s price is currently consolidating within a narrowing triangle, indicating a critical phase for short-term price action. Volatility has compressed as buyers and sellers converge, creating a balance zone that often precedes significant directional moves.

Key Technical Points

Triangle Apex Nearing Completion: ETH’s price is approaching the apex of a triangular structure, where support and resistance lines converge.

Point of Control (POC) as Balance Zone: The POC represents the price level with the highest traded volume in the range, acting as a pivot between bullish and bearish control.

Volume Confirmation Critical: A breakout’s validity depends on strong trading volume. Low participation increases the risk of false moves.

Market Indecision, Not Weakness

The consecutive lower highs and higher lows reflect a market in equilibrium rather than weakness. Buyers and sellers are evenly matched, causing reduced volatility. Such price compression is typical before expansion phases, where a directional decision must eventually emerge.

XRP STRUGGLES TO RECOVER, DROPS TO 6-WEEK LOW NEAR $2.12

Role of the Point of Control (POC)

Ethereum’s current positioning around the POC highlights market balance. Extended time at the POC often results in sharp rotational moves once price finds acceptance above or below this level. The POC can serve as a pivot point, determining whether bullish or bearish forces dominate the next move.

Breakout Scenarios

Bullish Breakout: A sustained close above the triangle’s resistance, ideally with rising volume, would signal upward momentum. Without volume support, breakouts often fail, leading to false moves.

Bearish Breakout: A drop below triangle support would suggest acceptance beneath value, likely targeting the Value Area Low (VAL). These levels often attract price after failed consolidations as markets rebalance supply and demand.

Importance of Volume

Volume acts as the defining factor for breakout validity. High participation confirms market conviction, while muted volume increases the chance of a failed move and continued range-bound trading.

Broader Market Structure

On the higher time frame, Ethereum remains range-bound. The triangle is a consolidation phase, not a confirmed trend reversal. Until price establishes acceptance above the Value Area High (VAH) or below the VAL, rotational movement is likely to persist.

Liquidity and Future Targets

After a confirmed breakout, ETH is often drawn toward the next major volume node, either the VAH or VAL. These zones represent areas of concentrated prior trading and usually act as natural targets for expansion following a compression-driven breakout.

What to Expect in Ethereum’s Upcoming Price Action

Ethereum is approaching the apex of its current triangle pattern, signaling that a period of volatility expansion is likely imminent. Traders should watch closely for signs that the market is ready to make a decisive move.

Potential Breakout and Directional Move

A breakout confirmed by strong trading volume could trigger a directional move toward the next significant value area. This would mark a clear expansion following the recent consolidation phase.

Caution Ahead: False Breakouts

Without sufficient volume, breakout attempts carry a high risk of failure. Traders should exercise caution, as the price may quickly revert to the triangle, creating false signals and trapping breakout participants.

Current Market Compression

Until Ethereum establishes clear acceptance above resistance or below support, price is likely to stay compressed around the Point of Control (POC). This zone reflects the balance between buyers and sellers and will guide the market’s next rotation.

Key Factors to Watch

- Volume: Confirms the validity of a breakout.

- Acceptance: Determines whether the price expands or continues to rotate within the triangle.

- Value Areas: Serve as natural targets once a directional move occurs.