SOLANA GAINS INSTITUTIONAL ATTENTION OVER BITCOIN, ETHEREUM, AND XRP—WHAT THIS COULD MEAN FOR SOL’S PRICE

Solana exchange-traded funds (ETFs) stood out last week by attracting strong investor inflows, even as the broader crypto market faced a downturn. The performance highlights growing institutional interest in SOL and has added momentum to bullish expectations for Solana’s price.

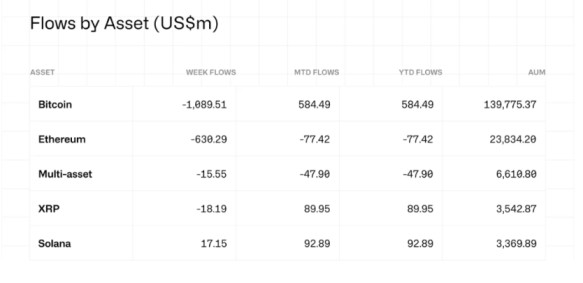

According to data from CoinShares, Solana-linked investment products recorded $17.1 million in net inflows over the past week. This came at a time when several major crypto funds were experiencing notable withdrawals.

Bitcoin, Ethereum, and XRP Products See Outflows

While Solana products gained traction, funds tied to other large cryptocurrencies moved in the opposite direction. XRP ETFs recorded $18.2 million in outflows, signaling weaker short-term demand.

Meanwhile, Bitcoin and Ethereum products saw even larger withdrawals. Bitcoin-related funds experienced $1.09 billion in outflows, while Ethereum products lost $630 million. These contrasting flows pushed the total assets under management in Solana exchange-traded products to approximately $3.37 billion.

The divergence suggests that some institutional investors may be rebalancing portfolios away from established assets and toward Solana.

Is Wall Street Shifting Its Focus Toward Solana?

The widening gap between Solana inflows and outflows from BTC, ETH, and XRP funds could indicate an early shift in institutional strategy. Rather than relying solely on long-established cryptocurrencies, investors appear to be allocating more capital to networks viewed as scalable and cost-efficient.

While it is too early to call this a long-term trend, the data does point to increasing confidence in Solana’s ecosystem among professional investors.

Solana Price Update: Key Levels to Watch

From a price perspective, Solana has shown resilience. Over the past 24 hours, SOL has gained around 1%, outperforming the other cryptocurrencies in the top five by market capitalization.

CRYPTO COULD SURGE AS $100T INHERITANCE WAVE RESHAPES INVESTING, SAYS CEO

Trading volume has eased slightly, which may indicate that recent selling pressure is weakening. Technically, SOL has broken out of a descending price channel and is now holding support near the upper boundary of that formation.

Why the $120 Level Matters

If Solana can maintain support above $120, the probability of a move toward $125 increases. A sustained breakout above that level could open the door for a rally toward $147, representing a potential upside of around 18% in the near term.

- Combined with ongoing institutional demand, the current technical setup leans cautiously bullish.

- Growing Institutional Interest Supports the Solana Ecosystem

As interest in Solana continues to expand, projects built within its ecosystem may also benefit. Increased institutional exposure often brings higher liquidity, broader visibility, and greater developer activity across related platforms.

GREENLAND DISPUTE STOKES FEARS OF $1.7T TREASURY DUMP AND A ROTATION TOWARD BITCOIN

Some newer blockchain initiatives are exploring ways to connect Solana’s high-speed, low-cost infrastructure with other major networks, including Bitcoin, aiming to expand use cases such as decentralized finance and payments.

Outlook Remains Cautiously Positive

While broader market conditions remain uncertain, Solana’s ability to attract ETF inflows during a period of widespread outflows is notable. If institutional demand holds and key price levels remain intact, SOL could continue to show relative strength compared to its peers.

As always, investors are advised to monitor market conditions closely and consider both technical signals and macro trends when evaluating price expectations.