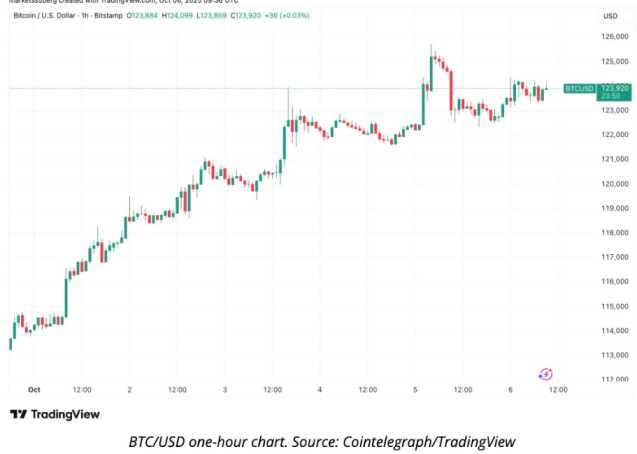

ANALYSTS VIEW BITCOIN DIP AS TYPICAL PRE-FOMC MOVE; PREDICT RALLY TOWARD $143K AFTER $120K BREAKOUT

After Bitcoin briefly spiked to around $116,094 and then pulled back, strong buying support emerged near $112,500. Market analysts believe that if Bitcoin breaks above the crucial $120,000 resistance, it could trigger a major bullish move, potentially pushing prices toward the $143,000 target.

Bitcoin traded around $113,000 as investors awaited the outcome of the Federal Open Market Committee (FOMC) meeting. All eyes are on Fed Chair Jerome Powell’s press conference scheduled for 2:30 p.m. ET, which could offer clues about the central bank’s next interest rate moves.

MARKET ANALYSTS PREDICT: BITCOIN NEEDS $120K BREAKOUT FOR RALLY TOWARD $143K

Crypto analyst Ali Martinez believes Bitcoin must break above $120,000 to set the stage for a move toward $143,000. In simple terms, he suggests that once Bitcoin surpasses the $120K level, there’s less resistance ahead—meaning the path toward the next major target around $143K could become much smoother.

Real Losses Were Much Lower Than $19B Despite Massive Crypto Liquidations

Ali Martinez bases his outlook on a long-term chart that uses pricing bands—smooth, curved lines derived from on-chain averages that act like lanes on a motorway. In his analysis, Bitcoin’s price currently sits just below a key band near $120,000. Once that level is reclaimed, the next upper band appears around $143,000, marking his next major target zone. He clarifies that this doesn’t guarantee Bitcoin will reach $143K but rather indicates that breaking above $120K could open up a clearer path with less resistance until the higher range.

Crypto analyst Michaël van de Poppe views the recent Bitcoin pullback as a normal correction within an ongoing uptrend rather than the start of a major downturn. He emphasizes the importance of the $112,000 level holding as strong support before expecting another push higher. In his words, the dip looks like a simple “check the floor” moment—a healthy pause before the next potential rally.

Van de Poppe’s medium-term chart highlights two key zones: a support floor near $112K and resistance between $115.6K and $116.2K. His analysis suggests that as long as Bitcoin continues to defend the $112K level, it could bounce back toward the upper range, signaling market stability and a possible move higher.

Bitcoin Surges to $112,000 Following Mild U.S. Inflation Report, Stocks Hit New Highs

Meanwhile, on-chain analytics firm Glassnode reports that a large number of recent buyers entered the market near $111,000, while heavier selling activity appears around $117,000. Simply put, $111K acts as a strong buying zone where bargain hunters step in, and $117K serves as a profit-taking area that can slow down rallies.

This data comes from Glassnode’s cost-basis distribution, which tracks where coins last changed hands. Peaks in this distribution show clusters of buyer and seller activity—with $111K providing support and $117K creating resistance. The key takeaway: a clear breakout beyond the $111K–$117K range could determine Bitcoin’s next major direction.

- Why did Bitcoin’s price drop recently?

The recent Bitcoin dip appears to be a routine correction ahead of the Federal Open Market Committee (FOMC) meeting. Analysts suggest it’s a normal pullback within an ongoing uptrend rather than the start of a major downturn.

2. What price levels are analysts watching right now?

Market experts are closely watching the $112,000 support and $120,000 resistance levels. Holding above $112K could keep Bitcoin stable, while breaking above $120K might open the way toward the next target around $143,000.

3. What does Ali Martinez predict for Bitcoin?

Crypto analyst Ali Martinez believes that once Bitcoin breaks above $120,000, the path toward $143,000 becomes clearer. His analysis is based on long-term pricing bands built from on-chain averages, showing reduced resistance above the $120K mark.

4. What is Michaël van de Poppe’s view on the current market?

Analyst Michaël van de Poppe sees the recent dip as a healthy “check the floor” moment—not a sign of a bearish reversal. He expects Bitcoin to recover as long as the $112K support holds strong.

5. What insights did Glassnode provide about Bitcoin’s trading range?

According to Glassnode, most recent buyers accumulated Bitcoin near $111,000, while sellers tend to appear around $117,000. This creates a tug-of-war zone, and a breakout beyond the $111K–$117K range could signal Bitcoin’s next major move.