ASIA MARKET OPEN: BITCOIN SLIDES AS ASIAN MARKETS TAKE CUES FROM TECH RECOVERY

Bitfinex reports that institutional investors are now absorbing around 13% more Bitcoin than the amount being newly issued, suggesting that supply pressure is easing. Analysts note strong buying interest in the $82,000–$85,000 range, which could help form a short-term price floor if current demand holds.

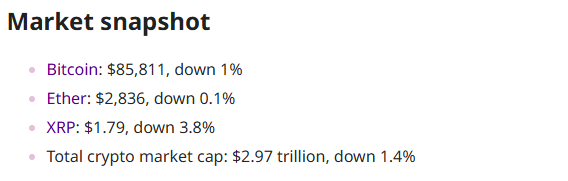

Bitcoin dipped to roughly $85,200 on Friday as Asian equity markets stabilized, following a technology-driven rebound on Wall Street. Market participants also shifted focus to Japan, where a potential interest rate decision by the Bank of Japan later in the day could impact regional currencies and bond markets.

Investor sentiment improved after U.S. inflation data showed an unexpected slowdown, with consumer prices rising 2.7%. However, analysts warned that the figure may be artificially low due to temporary factors linked to the government shutdown and advised caution when interpreting the data.

Source: cryptonews

Bitcoin Pullback Shifts Focus to Supply Dynamics and DeFi Activity

As Bitcoin retraces from recent highs, traders are paying closer attention to market positioning and capital flows rather than macroeconomic headlines. According to Bitfinex analysts, institutional investors are currently absorbing around 13% more Bitcoin than the roughly 450 BTC newly mined each day on a rolling basis.

“This represents the first clear supply imbalance since early November, even as concerns around ETF outflows persist,” the analysts noted.

From a technical standpoint, Bitcoin is showing solid buying interest between $82,000 and $85,000. Analysts say holding this range could help maintain positive momentum by reinforcing buyer confidence.

If support remains intact, it may encourage fresh liquidity through increased ETF inflows and lower selling pressure, creating conditions for continued accumulation and a potential move higher.

Source: cryptonews

Some market participants viewed the recent pullback as an opportunity to highlight Bitcoin’s longer-term utility. Dom Harz, co-founder of BOB, said short-term price swings do little to change Bitcoin’s broader potential.

He noted that despite Bitcoin’s market capitalization approaching $2 trillion, most BTC remains inactive. Only around 0.3% is currently used in native Bitcoin-based DeFi applications.

According to Harz, this largely untapped liquidity presents a major opportunity to expand Bitcoin’s role beyond simple storage of value. By enabling lending, borrowing, and yield-generating use cases—while keeping collateral secured directly on the Bitcoin network—BTC could see more productive, long-term adoption.

Inflation Keeps Pressure on BOJ as Yen Stability Remains Uncertain

Interest rate expectations shifted only slightly after the latest inflation data. Markets now price in a 27% chance of a U.S. Federal Reserve rate cut in January, while the probability of a March cut edged up to 58% from 54% before the report.

Japan became the main focus across Asian markets. Traders are pricing in nearly a 90% chance that the Bank of Japan will raise its policy rate by 25 basis points to 0.75% later on Friday. Investors are closely watching for signals on how aggressive the central bank may be in the future.

DECEMBER 8 CRYPTO UPDATE: BITCOIN, SUI, TAO, ENA BOUNCE BACK AFTER WEEKEND CRASH

At present, markets expect just one additional rate increase to 1.0% in 2026. Any suggestion of a faster tightening path could help stabilize the struggling yen, though it may increase pressure on government bond yields.

Fresh data showed Japan’s core consumer inflation rose 3.0% in November, unchanged from the previous month, keeping inflation concerns front and center ahead of the BOJ’s policy decision.

Asian Stocks Rise as Sentiment Improves

Equity markets reflected the cautiously optimistic tone. Japan’s Nikkei index gained 0.6%, while South Korea’s market jumped 1.2% following strong earnings from chipmaker Micron Technology. Meanwhile, MSCI’s Asia-Pacific index excluding Japan rose 0.2%.

Central Bank Signals Add Complexity to Global Markets

In the United States, S&P 500 and Nasdaq futures were little changed after an overnight rebound. Bond markets remained cautious, with the 10-year Treasury yield hovering near 4.13%, below its recent three-and-a-half-month high of 4.2%.

ETHEREUM ETF OUTFLOWS HIT $75.21M WHILE ETH PRICE FLATLINES AT $3K

Diverging central bank policies continued to complicate global bond and currency trading. UK government bonds declined after the Bank of England delivered a widely expected rate cut, approved by a narrow 5–4 vote. Policymakers also signaled caution on future easing, pushing expectations for the next full rate cut to June.

The European Central Bank struck an even firmer tone, holding rates at 2.0% and suggesting its easing cycle may be nearing an end. Markets now see only a small chance of further cuts through 2026. Sweden and Norway also kept rates unchanged, though Norway indicated it could still consider one or more cuts ahead.