BANKS TARGET STABLECOINS AND DEFI, SPARKING STRONG REACTIONS FROM THE CRYPTO COMMUNITY

The Bank Policy Institute (BPI) released a risk assessment on November 3, warning that stablecoins pose significant threats to retail investors and the stability of the financial system, even after the recent approval of a federal regulatory framework.

In response, Alexander Grieve, Vice President of Government Affairs at Paradigm, criticized the report on November 4, accusing the banking trade group of making bad-faith claims and relying on outdated arguments to oppose crypto innovation.

Stablecoins Face Banking Industry Pushback Despite New Regulatory Framework

According to BPI’s report, stablecoins fall into two primary risk categories:

- Events known as depegging have the potential to undermine stablecoins’ credibility as a reliable payment method.

- Exposure to DeFi lending platforms, which can increase leverage risks in ways traditional banks do not face.

The institute warned that deeper integration of stablecoins into traditional finance could, for the first time, allow crypto market volatility to spill over into the broader economy.

To support its position, BPI cited several historical depegging events, including USDT’s drop to $0.90 in October 2018 during Bitfinex withdrawal issues and USDC’s fall to $0.87 in March 2023 following the Silicon Valley Bank collapse. The report also referenced the October 10 incident, when the algorithmic stablecoin USDe briefly plunged to $0.65 amid U.S.–China trade tensions, resulting in nearly $20 billion in crypto liquidations.

Stablecoins Under Fire as Banking Groups Push Back on DeFi, Crypto Industry Responds

The Bank Policy Institute (BPI) published a detailed risk assessment on November 3, warning that stablecoins could threaten retail investors and overall financial stability, despite the recent approval of the federal regulatory framework for digital assets.

Stablecoin Uncertainty Increases as Banks Disband and Regulators Face Pressure

According to the BPI, stablecoins face two major risks: depegging events, which can undermine payment reliability, and exposure to DeFi lending, which introduces high leverage without traditional banking safeguards. The institute highlighted examples such as USDT’s drop to $0.90 in 2018, USDC’s fall to $0.87 during the Silicon Valley Bank collapse in 2023, and USDe’s temporary dip to $0.65 in October 2025 following global trade tensions.

DeFi Lending Risks: BPI Highlights Leverage Concerns

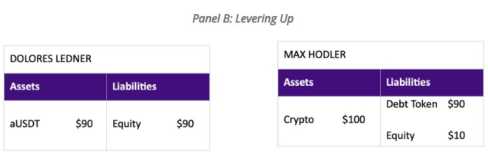

The report examined DeFi platforms like Aave, where investors earned around 4% lending stablecoins while borrowers paid 6% interest. The BPI noted that loan-to-value ratios above 90% effectively allow tenfold leverage, creating the risk of liquidation cascades during market downturns.

Furthermore, BPI emphasized that DeFi platforms lack critical financial protections—including deposit insurance, lender-of-last-resort access, capital requirements, and regulatory examinations—that are standard for banks.

Paradigm Fires Back Against Banking Industry Claims

On November 4, Alexander Grieve, Vice President of Government Affairs at Paradigm, criticized the BPI report, calling it narrow-minded and in bad faith. He accused the institute of taking an “if you can’t beat them, destroy them” stance toward stablecoins and suggested that former SEC Chair Gary Gensler’s allies may be influencing BPI’s anti-crypto policy direction.

Weekly Crypto Update: Bitcoin Stability and DeFi’s $153 Billion Surge

Grieve likened stablecoins to transformative inventions that evolved beyond their original purposes—citing Velcro (originally for astronaut suits), zippers, bubble wrap, and ETFs as examples of innovations that reshaped industries. He described stablecoins as “room-temperature superconductors for global money movement” when powered by the GENIUS Act framework.

He also urged the BPI to consult with member banks already experimenting with or planning to issue stablecoins, suggesting that many of them hold more forward-thinking views than the institute’s public stance.

Banking Sector Opposition Intensifies After GENIUS Act

The banking industry’s coordinated opposition to stablecoins grew stronger after President Donald Trump signed the GENIUS Act into law on July 18, 2025.

Initially, the American Bankers Association (ABA) supported the law’s goals but cautioned lawmakers to ensure it addressed financial stability and consumer protection. Soon after, both ABA and state associations pressed Congress to bar non-financial firms from issuing payment stablecoins and to close approval pathways for such entities.

At the same time, BPI launched a focused campaign urging Congress to eliminate the “interest loophole” in the GENIUS Act, arguing that allowing stablecoin yields could divert bank deposits into crypto products. On August 12, BPI called for stricter limits on stablecoin interest payments, warning that DeFi lending mirrored highly leveraged banking activities without capital or safety nets.

Banks Push for Stricter AML Rules and Regulatory Parity

In response to the U.S. Treasury’s August request for input on policing illicit finance in digital assets, major banking groups—including ABA, BPI, and The Clearing House—filed comments demanding “same activity, same risk, same rules” standards. They called for clearer KYC and AML frameworks to prevent regulatory arbitrage as DeFi and stablecoin adoption expands.

Community banks echoed similar concerns, stating most smaller institutions do not offer crypto services and warning of potential crime risks.

By November, BPI reiterated that even under the GENIUS Act, crypto-related crime pathways remain open and urged for tighter AML enforcement, noting that the Act is still not fully implemented.

- Since mid-2025, the core of the banking sector’s campaign has focused on three goals:

- Blocking non-bank entities from issuing stablecoins.

- Restricting interest or yield features on stablecoins.

- Tightening AML and KYC rules for DeFi and stablecoin activities.

This coordinated stance underscores how traditional financial institutions view stablecoins as a competitive threat to their deposit gathering and payment processing businesses.

Crypto Industry Calls for Innovation Over Restriction

Grieve’s rebuttal highlights the growing divide between legacy financial institutions seeking to limit stablecoin expansion and crypto advocates promoting it as legitimate financial innovation. He questioned whether relying on “politically motivated operatives” truly serves the long-term interests of the banking industry.