BINANCE CEO CZ SLAMS 60,000 BTC BITMEX HEDGE PROFIT STORY AS FALSE

CZ denies 60000 BTC BitMEX hedge profits: Changpeng Zhao, widely known as CZ, has firmly rejected claims that Binance secretly earned more than 60,000 BTC by hedging client exposure on BitMEX during the March 2020 market crash.

BNB BREAKS $620 FIBONACCI LEVEL, TESTS LONG-TERM SUPPORT NEAR $609

Responding to a viral social media allegation, Zhao described the story as “fake news” and said it was technically impossible. The claim suggested Binance hedged massive client flows on BitMEX during the Covid-era liquidation cascade and booked enormous profits in the process.

CZ Pushes Back on the BitMEX Hedge Narrative

The controversy gained traction after a post by Flood, CEO of fullstack_trade on Hyperliquid, alleged that Binance executed large-scale hedges on BitMEX, generating over 60,000 BTC in gains during the March 2020 crash.

Zhao dismissed the accusation outright, stating that Binance never traded on BitMEX. He criticized the claim as fabricated and said there was no proof to support it. To reinforce his argument, he tagged Arthur Hayes, co-founder of BitMEX, highlighting a key operational limitation at the time: BitMEX processed withdrawals only once per day.

According to Zhao, this withdrawal structure would have made real-time hedging of such magnitude practically unworkable during a fast-moving market collapse.

Traders and BitMEX Label the Claim “Impossible”

Several market participants quickly challenged the 60,000 BTC narrative. Commentators noted that in 2020, BitMEX’s once-daily withdrawal system would have prevented an exchange from executing and settling a hedge of that scale during a black swan event.

Critics of the allegation argued that no firm would risk locking 60,000 BTC in a manual multi-signature system amid extreme volatility. Some suggested the figure may stem from distorted memories of past market events rather than verifiable transaction records.

BitMEX has since stated that it has no records supporting the alleged flows. The exchange also pointed out that it later upgraded its infrastructure, moving from once-daily batched withdrawals to real-time processing as part of broader system improvements.

MARKET SEES FADING BEAR CASE AS ANALYSTS STAND BY $150K BITCOIN FORECAST

FUD, Industry Rivalries, and Lingering Distrust

Not everyone accepted the “fake news” characterization. A social media critic posting under the handle Broly argued that Binance has played a significant role in multiple major crypto downturns, referencing its involvement in the collapse of FTX and its prior exposure to Terra (LUNA) before withdrawals were halted.

While many observers dismissed the latest controversy as competitive FUD, the episode highlights how opaque cross-exchange flows and incomplete historical records can quickly give rise to conspiracy narratives. In a market still heavily influenced by screenshots, rumors, and social media threads, allegations can gain momentum long before verified data emerges.

Market Context: Bitcoin, Ethereum, and Solana Prices

The renewed debate unfolds against a backdrop of heightened macro-driven volatility in digital assets.

Bitcoin (BTC) is trading around $68,280, with a recent 24-hour range between approximately $64,760 and $71,450.

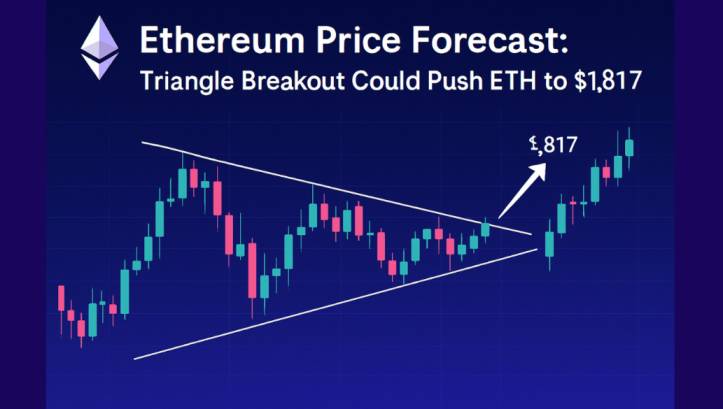

Ethereum (ETH) is hovering in the low-$2,000 range, with near-term levels clustered between $1,940 and $2,100.

Solana is changing hands between $78 and $81, broadly flat on the session following a modest pullback from recent highs.

As markets remain sensitive to liquidity shifts and risk appetite, the debate over Binance’s alleged 2020 trading activity serves as a reminder of how quickly narratives can resurface in crypto’s fast-moving ecosystem.

Conclusion

Changpeng Zhao has categorically denied claims that Binance earned 60,000 BTC by hedging on BitMEX during the March 2020 crash, labeling the allegation “fake news” and technically impossible under BitMEX’s withdrawal system at the time.

While critics continue to question Binance’s historical role in major crypto market events, neither BitMEX nor independent evidence supports the viral hedge-profit narrative. The episode underscores how quickly unverified claims can spread in crypto markets—especially during periods of renewed volatility in assets like Bitcoin, Ethereum, and Solana.

In a sector still shaped by intense competition, fragmented transparency, and social media–driven discourse, reputational battles can move just as fast as prices.