Bitcoin’s September 2025: Resilience Against the ‘Red September’ Curse

September is usually a rough month for Bitcoin, often called “Red September” because prices tend to fall as big investors adjust their positions or react to global events. This year, though, Bitcoin stayed steady. Week 38 was shaky, with a 5% drop—its third-worst week of 2025—right as the third quarter ended. Even so, Q3 still showed a small 1% gain, and overall, Bitcoin managed to hold flat through September, avoiding the usual downturn.

In 2025, even with global economic challenges and heavy selling across crypto markets, Bitcoin has stayed strong, avoiding a major crash. September’s crypto selloff shaved over $160 billion off the total market value, with many leveraged bets getting wiped out, but Bitcoin is holding its ground with surprising steadiness.

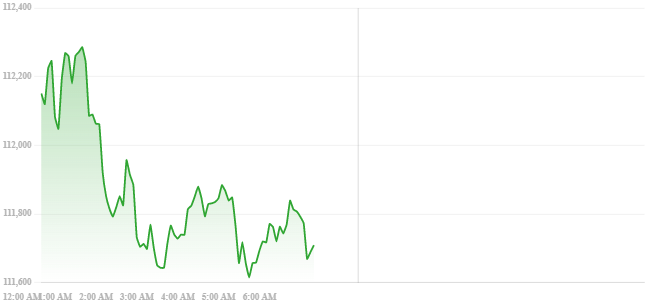

On Friday, over $17 billion worth of options expired. The max pain level—the strike price where option buyers lose the most and sellers gain the most—was set at $110,000, and it pulled the spot price toward it like a magnet.

Another important technical marker is the short-term holder cost basis at $110,775. This shows the average price at which coins traded in the past six months were last bought, giving a clear picture of near-term investor sentiment.

When you step back and look at the bigger trend, the key question is whether Bitcoin is still moving in an uptrend—making higher highs and higher lows—which would show that the rally has room to continue.

More for you:Solana and Ethereum Glow Like Bitcoin Eyes at $70,000

Analyst Caleb Franzen notes that Bitcoin has now slipped under its 100-day exponential moving average (EMA), an indicator traders watch closely. The longer-term 200-day EMA is sitting at $106,186, acting as a critical support level. The last major low was around $107,252 on September 1. For Bitcoin’s broader bullish trend to stay intact, the price will need to hold above that zone. Dropping below it could suggest the market is losing strength and may shift into a deeper correction.

Macro Environment for Bitcoin

The U.S. economy grew faster than expected in the second quarter, expanding at a 3.8% annual rate—the strongest since mid-2023. Fewer people filed for unemployment, with jobless claims falling to their lowest since July. Consumer spending matched forecasts, while the Fed’s key inflation gauge (core PCE) rose just 0.2% in August, showing price pressures remain under control.

In Short

Bitcoin entered September 2025 under warnings it could tumble to $100,000, yet it has managed to hold firm in the $110,000–$112,000 range. Despite a $160 billion wipeout from the broader crypto market and a sharp 5% dip in Week 38, the coin stayed resilient. Support from big investors, ongoing ETF interest, and a break from the usual “Red September” slump helped keep it steady. The road ahead still has challenges, but Bitcoin is proving its strength.

Weekly Crypto Update: Bitcoin Stability and DeFi’s $153 Billion Surge