Crypto Market Shows Signs of Recovery After Massive Deleveraging, Analysts Turn ‘Constructively Bullish’

After one of the biggest liquidation waves in recent times, triggered by last week’s sharp deleveraging across crypto derivatives, research firm K33 says the market is now moving into a healthier phase.

In its latest report, Vetle Lunde, Head of Research at K33, said that while investors should remain patient, the recent reset is actually “constructively bullish.” He explained that months of excessive leverage have now been cleared out, setting a stronger base for potential future growth.

Lunde added that liquidity might remain thin for a while as traders recover from forced sell-offs. However, history shows that such periods of market cleanup often mark turning points—leading to more stable and sustainable growth once conditions settle.

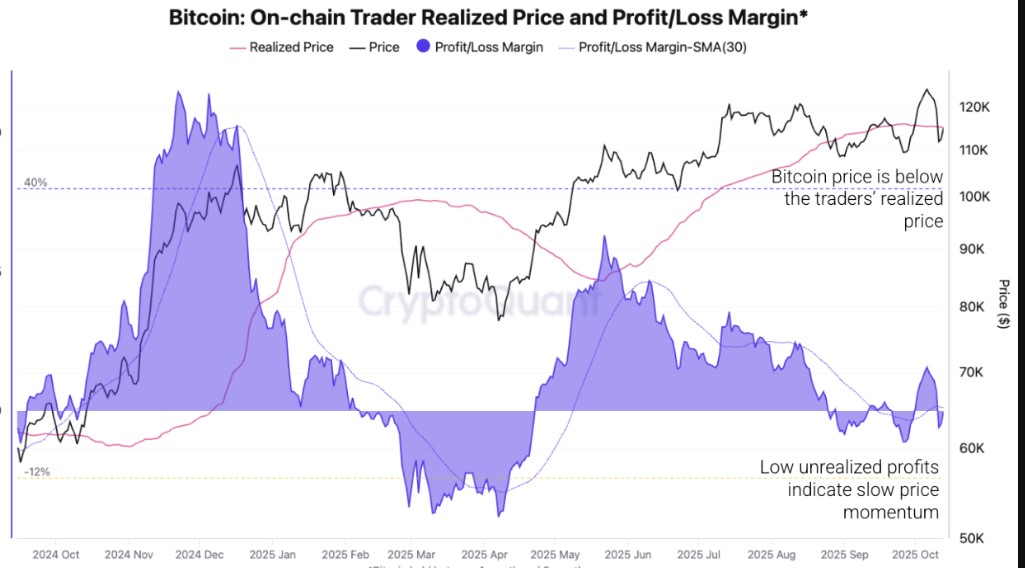

Bitcoin Market Faces Sharp Cleanup as Leverage Unwinds

On October 10, Bitcoin’s perpetual open interest dropped by almost 50,000 BTC (18.6%), marking the biggest single-day decline since August 2023. The sudden fall came as funding rates turned sharply negative, wiping out more than $16.7 billion worth of leveraged long positions and pushing open interest back to its Q2 lows.

According to K33 Research, Binance’s Bitcoin perpetual contract even traded at a 5.1% discount to spot prices—the widest gap since the March 2020 Covid crash. Analyst Vetle Lunde said this massive sell-off confirmed K33’s earlier warnings about excessive leverage in the market and could represent an important turning point toward a healthier market phase.

SOLANA PRICE OUTLOOK: TECHNICAL UPGRADES MAY DRIVE MAJOR SHIFT TOWARD $1,000

Lunde explained that over the past three years, similar drops in open interest have often signaled market bottoms, suggesting that the downside risk from here may be limited. Historically, when Bitcoin’s perpetual leverage has fallen by more than 10% in a single day, the market has typically seen only minor pullbacks afterward—often followed by steady long-term gains.

ETHEREUM CLIMBS BACK TO $4,700 AS BULLISH MOMENTUM STAYS STRONG

He added that the broader environment also looks supportive, with expectations of looser fiscal and monetary policies, rising institutional interest, and potential ETF approvals all helping to create a favorable setup for gradual accumulation in the crypto market.

Altcoins Faced Heavy Losses but Market Outlook Improves

While Bitcoin’s price swings drew most of the attention, K33 Research noted that several altcoins “flirted with the apocalypse.” According to the report, relative leverage in altcoin perpetual contracts — measured by open interest compared to market capitalization — fell sharply from 4.1% to 3.2%, a 22.1% reduction in leverage. This was the largest contraction in four years, even bigger than the pullbacks seen during the 2022 FTX collapse or earlier tariff-related selloffs.

Some tokens experienced extreme volatility. For instance, Cosmos (ATOM) briefly crashed from $4.06 to just $0.001 on Binance during the height of the turmoil. To control cascading losses, exchanges activated auto-deleveraging systems, closing profitable short positions while liquidating over-leveraged long trades. Lunde said the sheer scale of the event likely wiped out many traders and may have pushed some smaller funds into insolvency, calling it a “rare and highly destabilizing” but ultimately cleansing moment for the market.

Despite the chaos, Lunde struck an optimistic tone:

“Following this dramatic deleveraging, we are turning increasingly optimistic. With excessive leverage purged and structural risks reduced, the market setup now looks far healthier,” he said.

He added that the coming weeks could present a good opportunity for strategic accumulation in Bitcoin, as the recent reset and funding normalization may help build a stronger foundation for future growth.