CRYPTO STOCKS RISE WITH BITCOIN AND NASDAQ AMID OPTIMISM OVER U.S.-CHINA TRADE TALKS

Crypto-related stocks rose on Monday after President Donald Trump and Treasury Secretary Scott Bessent expressed optimism about progress in ongoing U.S.-China trade negotiations.

Trump told reporters that he “really feels good” about the potential deal, which could allow China to keep supplying rare-earth magnets—essential materials used in electric vehicles and smartphones—to the U.S. In return, the U.S. may ease the recently announced 100% tariff threat, signaling a possible breakthrough in trade relations.

The rally came after upbeat weekend remarks from Treasury Secretary Scott Bessent, which pushed Bitcoin to as high as $116,200 on Sunday before easing slightly to around $115,000.

Real Losses Were Much Lower Than $19B Despite Massive Crypto Liquidations

On Monday, several crypto-linked stocks also moved higher. Robinhood (HOOD) gained 5%, while Bitcoin mining and AI infrastructure companies such as Hut 8 (HUT), CleanSpark (CLSK), and IREN (IREN) rose between 2% and 3%.

American Bitcoin (ABTC), led by Eric Trump, saw its shares jump 10.5% after announcing the purchase of an additional 1,414 bitcoins, bringing its total holdings to 3,865.

In contrast, stablecoin issuer Circle slipped 2.3%, lagging behind the broader crypto market.

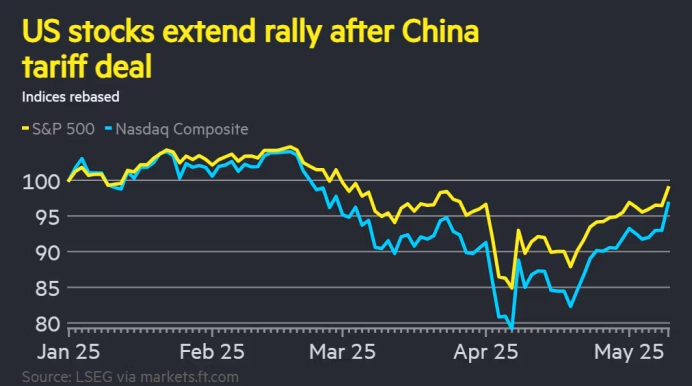

Traditional markets also rallied, with the Nasdaq gaining 1.5% and the S&P 500 up 1%. Meanwhile, previously hot commodities cooled off—gold dropped 3.2% and silver slid 4.5% as investors shifted toward riskier assets.

STABLECOINS ARE BECOMING MORE POPULAR, BUT HIGH FEES STILL FRUSTRATE USERS

President Trump is expected to meet with Chinese President Xi Jinping on Thursday, with rare-earth elements—vital for electric vehicles, wind turbines, and military technology—at the heart of the trade discussions. China currently produces about 70% of the world’s supply of these materials.

The broader market rally comes as traders await the Federal Reserve’s policy decision. The central bank is widely anticipated to cut interest rates by 25 basis points, a move that could lower borrowing costs and further boost investor appetite for cryptocurrencies and tech stocks.

FAQs

1. Why did crypto-related stocks rise on Monday?

Crypto stocks gained ground after President Donald Trump and Treasury Secretary Scott Bessent expressed confidence in progress on U.S.-China trade talks. The positive tone boosted investor optimism and lifted both crypto and traditional markets.

2. How did Bitcoin react to the news?

Bitcoin jumped to $116,200 on Sunday following upbeat comments from Treasury Secretary Scott Bessent. The world’s largest cryptocurrency later stabilized around $115,000 after a brief pullback.

3. Which crypto-linked companies saw major gains?

Trading platform Robinhood (HOOD) climbed 5%, while Bitcoin mining and AI-related firms such as Hut 8 (HUT), CleanSpark (CLSK), and IREN (IREN) advanced between 2% and 3%.

4. What happened to American Bitcoin (ABTC) and Circle?

American Bitcoin (ABTC), led by Eric Trump, surged 10.5% after adding 1,414 more bitcoins to its holdings. Meanwhile, stablecoin issuer Circle slipped 2.3%, underperforming the broader crypto market.

5. What’s driving the broader market optimism?

Investors are awaiting the Federal Reserve’s upcoming rate decision, with expectations of a 25-basis-point rate cut. This could reduce borrowing costs and encourage more investment in cryptocurrencies and tech stocks. At the same time, traditional markets like the Nasdaq and S&P 500 also rallied, while gold and silver lost some shine.