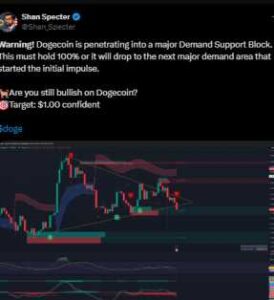

IS DOGECOIN READY FOR A BREAKOUT? $1 TARGET LOOMS AS PRICE HOLDS $0.16

Dogecoin’s price has successfully defended the $0.16 support zone in recent sessions, keeping sellers in check and strengthening market confidence. Repeated tests of this key level suggest that buyers remain active and willing to accumulate, turning the $0.16 region into a solid foundation for potential upside movement.

The $19 Billion Crypto Crash That Shook the Market

The recent consolidation phase — where price movements became tighter — is often seen as a prelude to a larger directional move in the crypto market. By holding firm at this base, Dogecoin has reduced the risk of sharp, unpredictable price swings caused by minor market headlines or sentiment shifts.

Momentum Signals Show Recovery

The Relative Strength Index (RSI), which tracks the speed and strength of price changes, has also shown early signs of recovery. After previously dipping toward oversold levels, the RSI has now started to climb, suggesting that buying momentum is gradually returning.

This improvement in momentum aligns with the pattern of higher lows, hinting at a possible trend reversal. If this continues, it could pave the way for Dogecoin to test the next major resistance zones in the coming days.

Why the $0.16 Zone Matters?

The $0.16 region is proving to be a psychological and technical stronghold for Dogecoin. Buyers consistently stepped in whenever the price approached this level, showing clear signs of accumulation rather than panic selling. This kind of behavior often signals preparation for a larger upward move.

Support levels like this typically attract traders who prefer defined risk zones—areas where they can confidently enter trades knowing where to place stop-losses. Because this level also aligns with a round number, it draws additional attention and liquidity from the broader market.

U.S. Companies’ Bitcoin Holdings Near 1 Million BTC, Valued at $115 Billion

Even as the overall crypto environment shifted throughout the week, Dogecoin managed to respect this support shelf, with every dip below it being short-lived and followed by quick rebounds. As trading ranges narrowed, many analysts now expect a volatility breakout—a move that could determine Dogecoin’s next major direction.

Dogecoin Price Setup: Everything You Need to Know

Dogecoin’s price momentum has started to turn upward, with sellers losing pressure near the $0.16 support zone. Buyers have tested short-term trend lines that previously capped rebounds, signaling a potential shift in market sentiment.

On intraday charts, Dogecoin has formed a rising channel—a pattern of higher highs and higher lows—which traders often use to spot breakout triggers and manage risk. Although volume confirmation has been limited, a decisive close above the nearest resistance could strengthen the case for a continued recovery.

Until that happens, sideways consolidation near the base remains a healthy sign, allowing the market to absorb selling pressure. Multiple successful tests of support, with quick rebounds, suggest steady dip buying rather than forced liquidations—a structure that supports a constructive bullish outlook if momentum continues.

Technical Indicators Point to Improving Structure

Analysts are closely watching indicators like the Relative Strength Index (RSI) and moving averages to gauge the strength of Dogecoin’s uptrend. Rising averages and an RSI trending higher often confirm improving momentum and broader market participation.

On the price chart, Dogecoin continues to trade within a rising channel connecting recent swing highs and lows. A breakout above this channel would likely indicate acceleration, while remaining within it suggests an orderly and measured advance.

Traders remain cautious of false breakouts, which can trap late buyers. To confirm trend strength, many look for a daily close above resistance combined with increasing trading volume—a signal that genuine buying demand is returning.

Dogecoin also tends to move in correlation with larger-cap tokens, meaning that broader crypto market strength can further validate its bullish setup. However, chart structure and momentum remain the most critical factors to watch in the short term.

What Lies Ahead for Dogecoin?

Market participants are tracking three key price levels for Dogecoin in the coming sessions:

- $0.40—A historical congestion zone and short-term target.

- $0.80—A major resistance where prior rallies paused.

- $1.00—A strong psychological barrier that could define the next phase of Dogecoin’s rally.

A sustained move above resistance with higher lows and a constructive RSI would confirm the next leg upward. Conversely, a failure to hold the base could delay the breakout setup.

As traders plan for both scenarios, Dogecoin’s consolidation and tightening range suggest that a significant move may be approaching—one that could determine whether the meme coin legend takes another shot at the $1 milestone.