MICHAEL SAYLOR’S COMPANY ACQUIRES 390 MORE BTC IN LATEST $43 MILLION BUY

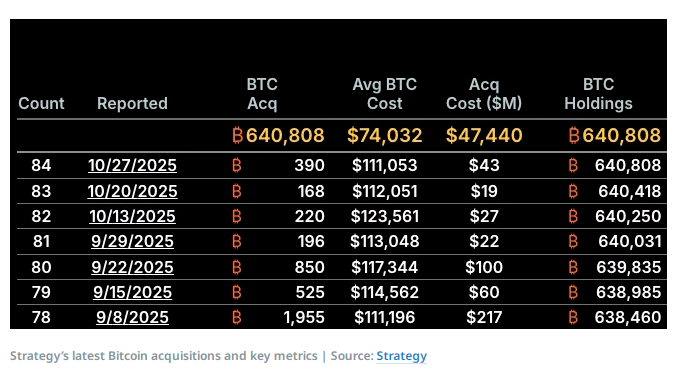

Michael Saylor isn’t slowing down on Bitcoin just yet. Despite growing debate over whether BTC is overheated, the MicroStrategy founder reaffirmed his bullish stance with another major purchase. On September 27, the company bought 390 more Bitcoin for $43 million, paying an average of $111,117 per coin.

XRP PRICE STRENGTHENS AROUND $2.70 WITH SUPPORT FROM 200-DAY MOVING AVERAGE

In its latest move, MicroStrategy financed the Bitcoin purchase using preferred stock issuance through an at-the-market (ATM) program, rather than relying on cash reserves or new debt. This strategy enables the company to expand its Bitcoin holdings without straining short-term liquidity—although it may lead to shareholder dilution over time.

This marks MicroStrategy’s third Bitcoin acquisition this month, bringing its total purchase to 914 BTC worth about $101 million. The company paid an average of $110,500 per coin, which is nearly 49% higher than its overall average cost of $74,032 per BTC.

MicroStrategy Accelerates Its Bitcoin Buying Spree

MicroStrategy continues its aggressive Bitcoin accumulation strategy, signaling Michael Saylor’s unwavering belief that BTC remains undervalued—even near its historic highs.

The market seems to share that sentiment. Following the latest purchase announcement, MicroStrategy (MSTR) shares rose 2.69% during trading hours, closing at $296.67 on the same day.

Despite this short-term boost, the company’s stock remains notably more volatile than Bitcoin itself. Over the past three months, MSTR has declined by approximately 26%, reflecting broader turbulence in the cryptocurrency market. However, it’s still up 16% year-over-year, showing long-term investor confidence.

BITCOIN JUST CROSSED $125,600—COULD IT REALLY HIT $150K NEXT?

MicroStrategy remains the largest corporate holder of Bitcoin, with a total of 640,808 BTC. This represents roughly 3% of Bitcoin’s total capped supply of 21 million and over 5% of the current circulating supply, which stands at around 19.5 million BTC.

FAQs

- Why did Michael Saylor’s MicroStrategy buy more Bitcoin?

Michael Saylor believes Bitcoin remains undervalued despite its current high price levels. The company’s latest $43 million purchase reflects his ongoing conviction that BTC will appreciate in the long term and serve as a superior store of value compared to traditional assets.

- How much Bitcoin did MicroStrategy buy in this latest purchase?

MicroStrategy acquired 390 additional BTC for about $43 million, paying an average price of $111,117 per coin. This brings the company’s total Bitcoin holdings for the month to 914 BTC, worth roughly $101 million.

- How did MicroStrategy fund the Bitcoin purchase?

Instead of using cash or taking on debt, MicroStrategy used a preferred stock issuance through an at-the-market (ATM) program. This allows the firm to increase its Bitcoin holdings without draining liquidity, though it can dilute shareholder value over time.

- How has MicroStrategy’s stock (MSTR) reacted to the purchase?

After the announcement, MSTR stock gained 2.69%, closing at $296.67. Despite recent market volatility leading to a 26% drop over the past three months, the stock remains up 16% year-over-year, signaling continued investor confidence.

- How much Bitcoin does MicroStrategy hold in total?

MicroStrategy currently holds 640,808 BTC, making it the largest corporate Bitcoin holder in the world. This represents about 3% of Bitcoin’s total supply cap and over 5% of its circulating supply—a massive position that underscores Michael Saylor’s long-term faith in Bitcoin.