SAYLOR TRANSFERS $2.45B WORTH OF BITCOIN—WHAT’S BEHIND THE MASSIVE MOVE?

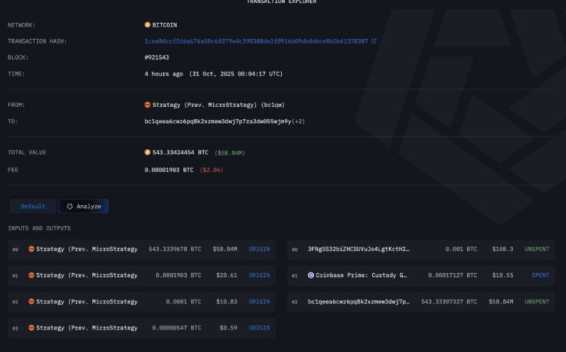

Michael Saylor, the co-founder and executive chairman of MicroStrategy, has reportedly transferred more than $2.45 billion worth of Bitcoin (BTC) to multiple new wallets, sparking speculation across the crypto community. The move, first flagged by on-chain analysts, has left investors debating whether this is part of a strategic restructuring or a potential liquidation plan.

Bitcoin Price Dips amid $1.2B ETF Outflows; $107K Support Becomes Key

Massive Bitcoin Movement Raises Eyebrows

According to blockchain tracking firm Arkham Intelligence, several large transactions totaling 36,000 BTC were recently moved from MicroStrategy-associated wallets. The transfers occurred in a coordinated manner, with funds distributed across new, unlabelled addresses.

This marks one of the largest wallet reorganizations linked to MicroStrategy since its initial Bitcoin purchases began in 2020. The company currently holds over 226,000 BTC, valued at nearly $15 billion, making it the world’s largest corporate holder of Bitcoin.

While some investors feared a possible sell-off, early indications suggest otherwise. No coins have been sent to exchanges—a typical sign of liquidation—hinting that the move might be part of internal restructuring or enhanced custody management.

Real Losses Were Much Lower Than $19B Despite Massive Crypto Liquidations

Analysts: “This Looks Like a Cold Wallet Reorganization”

Blockchain analysts and industry experts were quick to weigh in.

“This looks more like a cold wallet restructuring rather than preparation for a sale,” said Ali Martinez, a well-known on-chain analyst. “MicroStrategy has consistently demonstrated a long-term conviction in Bitcoin. These types of movements are often for security or auditing reasons, not liquidation.”

In previous interviews, Saylor has reiterated that MicroStrategy never plans to sell its Bitcoin holdings, describing the asset as the company’s “primary treasury reserve.”

MicroStrategy’s Bitcoin Strategy Still Intact

MicroStrategy began its Bitcoin accumulation strategy in 2020, citing the cryptocurrency as a superior hedge against inflation compared to cash or bonds. Since then, the firm has continued to purchase BTC through both direct buys and debt-financed instruments.

Despite recent market volatility, Saylor’s conviction appears unwavering. In his most recent post on X (formerly Twitter), he reaffirmed his bullish stance, stating:

“Bitcoin is the ultimate asset for those who think long-term. Volatility is the price you pay for performance.”

Market Reaction Remains Cautious

Following the news, Bitcoin prices briefly dipped below $91,000 as traders reacted to the wallet movement reports. However, prices quickly stabilized as more details emerged suggesting that the transfer was not linked to exchange activity.

Still, the event has fueled market speculation, with some analysts warning that such large wallet reorganizations can signal upcoming institutional reshuffling or collateral management for loans or ETF structures.

What’s Next for Bitcoin and MicroStrategy?

If the move was purely a security measure, it reinforces MicroStrategy’s reputation for strong custodial discipline. However, if linked to a new financial strategy—such as Bitcoin-backed lending, ETF restructuring, or collateral repositioning—the implications could be significant for both institutional investors and market liquidity.

For now, Saylor and MicroStrategy have not issued an official statement regarding the transactions, leaving room for continued debate in the crypto community.

At the time of writing, Bitcoin trades at around $91,300, holding steady despite broader market volatility. Investors continue to monitor on-chain data closely for any further movement of MicroStrategy’s wallets.