SharpLink Adds 19K Ethereum to Treasury amid Market Decline; Total Value Hits $3.5B

As Ethereum’s price slips, major firms are taking advantage of the dip. Joe Lubin-backed SharpLink has increased its holdings to 859,853 ETH (worth about $3.5 billion), while Tom Lee’s BitMine has accumulated 3.24 million ETH—roughly 2.7% of the total supply, valued at around $13 billion.

Ethereum’s price has faced some downward pressure lately, but big investors are still showing strong confidence in the world’s second-largest cryptocurrency.

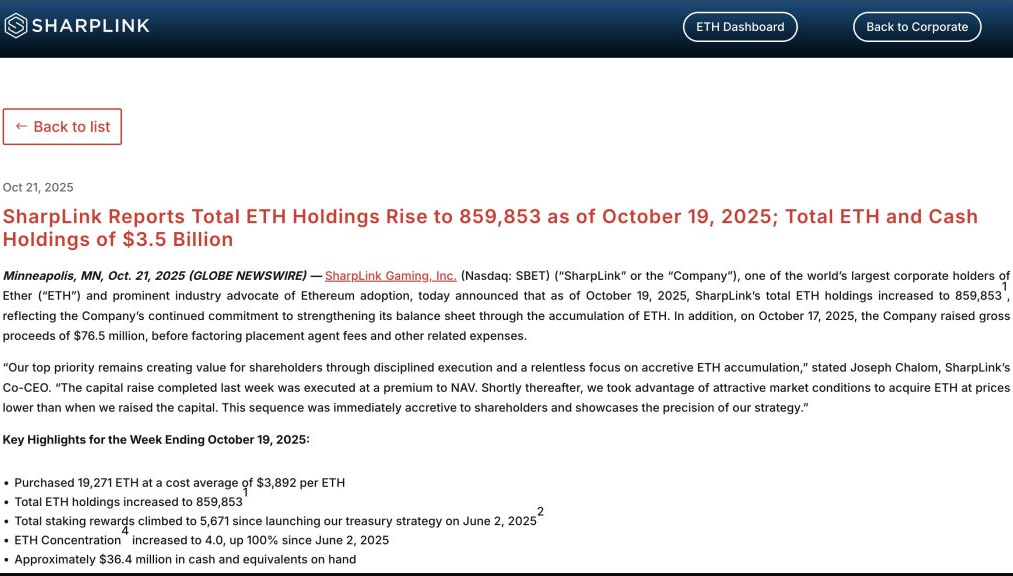

SharpLink Gaming, one of the biggest corporate holders of Ether, has boosted its treasury by adding more than 19,000 ETH this week, even as the broader crypto market remains weak.

According to the company’s latest update, SharpLink’s total Ethereum holdings have now reached 859,853 ETH as of October 19, 2025—a stash worth about $3.5 billion when combined with its cash reserves.

At the time of writing, Ethereum (ETH) was trading near $3,960, down 0.7% in the last 24 hours and roughly 12% over the past month, showing short-term weakness but continued long-term confidence from institutional players.

The token has been falling as a result of macroeconomics, and President Donald Trump’s tariff war with China has threatened to impose tariffs of up to 155% on Chinese goods starting on November 1st.

However, despite this, investors are using the opportunity to stack up their top token for when the market stabilizes, of which SharpLink is one lately, and BitMine recently too.

Ethereum’s recent price decline has been influenced by global macroeconomic factors, including renewed trade tensions between the U.S. and China. President Donald Trump’s ongoing tariff dispute has raised the possibility of imposing tariffs of up to 155% on Chinese goods starting November 1st, creating uncertainty across global markets—including crypto.

Bitcoin Miner Bitfarms Expands Convertible Notes Deal to $500 Million

Even so, many investors see the current dip as a chance to accumulate more of their preferred digital assets. SharpLink has recently increased its Ethereum holdings, joining BitMine, which also expanded its reserves, as both firms position themselves for potential gains once the market stabilizes.

SharpLink Doubles Down on ETH After $76M Capital Boost

SharpLink has strengthened its position in Ethereum after securing a $76 million capital injection, signaling strong confidence in the digital asset’s long-term outlook. The company confirmed that it purchased 19,271 ETH during the week at an average price of $3,892 per token, describing the move as a strategic response to what it called “attractive market conditions” following a sharp sell-off across the broader crypto market.

This latest purchase highlights SharpLink’s continued commitment to expanding its crypto treasury, even as market volatility persists. By buying into the dip, the company joins other institutional players taking advantage of lower prices to accumulate Ethereum ahead of a potential market rebound.

The company’s ETH concentration ratio—a proprietary transparency metric that tracks Ethereum holdings per 1,000 diluted shares—has doubled since June, reaching 4.0, which highlights SharpLink’s expanding Ethereum-weighted balance sheet.

In addition to its crypto assets, SharpLink reported maintaining around $36.4 million in cash and cash equivalents, reinforcing its strong liquidity position.

$536 Million Exits Spot Bitcoin ETFs—Largest Daily Outflow in Months

Meanwhile, market analysts believe that this recent wave of corporate Ethereum accumulation, driven by major players like SharpLink and BitMine, could serve as the foundation for the next phase of institutional growth in the Ethereum ecosystem.