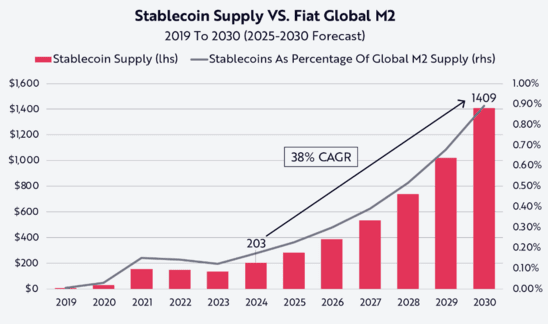

STABLECOINS ARE BECOMING MORE POPULAR, BUT HIGH FEES STILL FRUSTRATE USERS

As stablecoins gain mainstream use for daily transactions, users are discovering that the speed and ease they offer often come with higher transaction fees.

According to new data from New York-based blockchain analytics firm Artemis, stablecoin payments are growing rapidly across multiple sectors—even though transaction fees often rival or surpass those in traditional banking systems.

Artemis analyzed data from 22 stablecoin payment firms and used estimates from 11 additional providers, reporting a total of $136 billion in stablecoin transactions between January 2023 and August 2025. The study projects an annualized run rate of $122 billion, showing strong momentum in adoption.

- B2C transactions: $3.3 billion

- Card-linked payments: $18 billion

- B2B payments: $76 billion (leading segment)

- Peer-to-peer transfers: $19 billion

- Prefunding operations: $3.6 billion

U.S. Companies’ Bitcoin Holdings Near 1 Million BTC, Valued at $115 Billion

Tether’s USDT remains the clear market leader, accounting for 85% of total stablecoin transaction volume, followed by Circle’s USDC. Most of this activity takes place on major blockchains, including Tron, Ethereum, Binance Smart Chain, and Polygon.

Stablecoin Evolution

According to Artemis co-founder Anthony Yim and data scientist Andrew Van Aken, stablecoins have shifted from being tools mainly used by crypto traders to becoming a mainstream payment option. Global payment giants like Visa, Mastercard, PayPal, and Stripe are now integrating stablecoin functionality into their networks—a sign of growing confidence and real-world utility.

Artemis says its dataset is the most comprehensive analysis to date, covering 33 firms and capturing the majority of stablecoin payment activity currently driving the sector’s rapid growth.

However, this rapid growth comes with a downside. While peer-to-peer transfers on efficient blockchains like Solana can cost only a fraction of a cent, the exchange and conversion fees—including trading costs, network transfer charges, and foreign exchange spreads—often add up, diminishing the overall savings and making transactions more expensive than they appear.

Shark Tank investor Kevin O’Leary recently called out this issue on X (formerly Twitter), pointing to how Ethereum network congestion pushed transaction fees above $1,000 for even small transfers—a clear reminder of the system’s scalability problems.

“That’s like paying a thousand-dollar toll to drive on a one-lane highway,” O’Leary said. “It proves what I’ve been saying for years: when real traffic hits the system, it cracks under pressure.”

He further emphasized the need for stronger blockchain infrastructure:

“For over a decade, we’ve talked about going on-chain, and now with real-world adoption finally happening, the cracks are showing. Innovation isn’t just about hype or speculation—it’s about building systems that can actually handle scale.”

Stablecoin Regulation and Conflicts of Interest

The Artemis report comes just months after President Donald Trump signed the Genesis Act, a new law designed to create a federal regulatory framework for stablecoin issuers. However, critics argue that the legislation falls short on consumer protection and fails to address potential conflicts of interest.

A key concern centers on the Trump family’s majority ownership—around 60%—of World Liberty Financial, a crypto venture that recently launched its stablecoin, USD1. The token has gained traction following news that a $2 billion investment fund from the United Arab Emirates used USD1 to acquire a stake in Binance, the world’s largest cryptocurrency exchange.

In a controversial move, President Trump also pardoned Binance founder Changpeng Zhao earlier this week, following his conviction for failing to prevent illicit transactions on the platform.

Like other stablecoins, USD1 is pegged to fixed assets such as the U.S. dollar, enabling issuers to earn profits from interest on Treasury bonds and other reserves backing the token.

Crypto Market Stalls Ahead of U.S. CPI Data—BTC, ETH, SOL, and BNB Unchanged

Despite these regulatory and ethical concerns, Artemis’ research underscores the continued rise of stablecoin payments across both business and consumer sectors—even though their overall share remains modest compared to traditional financial systems.

FAQs

Q1. Why are stablecoins becoming popular?

Stablecoins are gaining popularity because they combine the speed of cryptocurrency with the stability of traditional money. They’re widely used for cross-border payments, online purchases, and business transactions, offering stability without the price volatility of Bitcoin or Ethereum.

Q2. Which stablecoin dominates the market?

Tether’s USDT leads the market, handling about 85% of all stablecoin transactions, followed by Circle’s USDC. Most of these transactions take place on blockchains like Tron, Ethereum, Binance Smart Chain, and Polygon, which power the majority of global stablecoin activity.

Q3. Why are stablecoin fees still high?

Although some networks like Solana offer very cheap transfers, users often face hidden costs such as exchange fees, network transfer charges, and currency conversion spreads. These can make stablecoin transactions as costly as traditional banking in some cases.

Q4. What is the Genesis Act, and why is it important?

The Genesis Act, signed by President Donald Trump, sets up a federal framework to regulate stablecoin issuers in the U.S. However, critics say it doesn’t do enough to protect consumers or prevent conflicts of interest—especially since Trump’s family has major stakes in a stablecoin company called World Liberty Financial.

Q5. Are stablecoins replacing traditional payments?

Not yet. While stablecoin payments are growing rapidly across business and consumer markets, their total volume is still small compared to global payment systems like Visa or PayPal. Analysts believe that better regulation and lower fees could make stablecoins a mainstream payment option in the coming years.