Weekly Crypto Update: Bitcoin Stability and DeFi’s $153 Billion Surge

Weekly Crypto Update:

The largest virtual Bitcoin sale to date occurred when an early investor sold 80,000 BTC for nearly USD 9 billion.

In the ever-evolving world of virtual currencies, the crypto market experienced both reversals and successes throughout the last week. The total value locked (TVL) in decentralized finance (DeFi) platforms reached an astounding $153 billion, while Bitcoin showed remarkable resiliency.

Key Points:

- Bitcoin stayed stable following a $9 billion sell-off, reflecting high investor confidence.

- DeFi protocols’ Total Value Locked (TVL) increased to $153 billion, showing their quick uptake.

- Due to significant liquidity and consumer demand, platforms such as Uniswap, Aave, and Lido drove DeFi’s expansion.

- Analysts see DeFi’s growth and Bitcoin’s stability as hallmarks of a growing cryptocurrency ecosystem.

- Both Bitcoin and DeFi may reach new highs in the upcoming months if momentum keeps up.

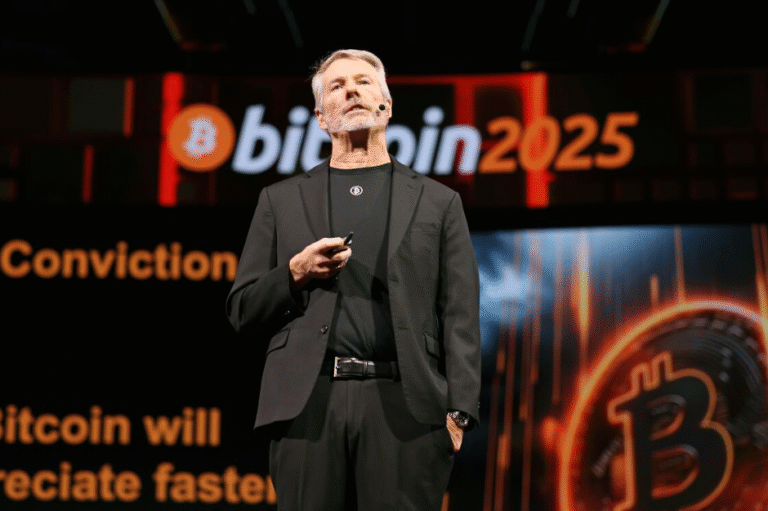

Bitcoin Can Handle a $9 Billion Sell-Off

In a short period of time, more than $9 billion worth of Bitcoin was sold off due to strong sell pressure. The biggest cryptocurrency in the world, however, held firm, circling its main support levels. This consistency is a sign of long-term investor trust and increasing market maturity.

Traders noticed slight price swings but no significant crashes, indicating that Bitcoin is becoming more and more regarded as a “digital gold” or safe-haven commodity, particularly in times of global economic uncertainty.

The DeFi Market Hits New Highs

According to data from DefiLlama, DeFi (Decentralized Finance) made news by hitting a Total Value Locked (TVL) of $153 billion, as Bitcoin fought sell pressure. This milestone demonstrates growing confidence in financial services based on blockchain, such as yield farming, staking, and lending.

Leading protocols, including Aave, Lido, and Uniswap, drew both individual and institutional players looking for alternatives to conventional financial institutions and banks.

What’s Driving DeFi’s Development?

Mainstream Adoption: Because DeFi apps are more transparent and accessible, more consumers are investigating them.

Increased Yields: DeFi technologies provide tempting profits in contrast to ordinary banking.

Stablecoin Utility: Growing usage of USDT, USDC, and DAI in liquidity pools and DeFi trading.

Market Prospects: What’s Next?

According to experts, Bitcoin’s resilience in the face of intense sell pressure is encouraging for the market as a whole. Conversely, DeFi’s steady growth indicates user confidence in decentralized solutions and, if present trends continue, could propel the industry to new heights.

Even while volatility still exists, both Bitcoin and DeFi seem to be headed in a bullish direction in the long run.

The Final Analysis

The week was significant for the development of cryptocurrency in 2025. With Bitcoin surviving a $9 billion sell-off and DeFi platforms surpassing $153 billion in TVL, the market is demonstrating resilience, expansion, and maturation. Both analysts and investors are keeping a careful eye on these changes because they have the potential to influence how finance develops in the years to come.